Best Accounting App For Mac And Ipad

Just because you’re a Mac person doesn’t mean you have to settle for less with your accounting software. Check out these 6 great options.

Jan 28, 2019 The Best iPad Apps doesn't include games or preinstalled apps. The former aren't included because default apps are easy to find—they already live on your iPad's home screen. Aug 13, 2019 Top 5 Best Personal Accounting Software for Mac and Windows #1. PDFelement Pro. Accounting requires documentation and therefore you need. IBank 5 is a program that is designed to help you keep your earnings. Moneydance is another personal finance program that comes. All-in-one, client-focused project management for teams. This app is designed for both iPhone and iPad. Requires iOS 6.0 or later. Compatible with iPhone, iPad, and iPod touch. All-in-one, client-focused project management for teams. Banktivity 5. Banktivity formerly known as iBank 5, is one of the best personal finance software for mac in Apple Store. YBanktivity finance management software is the best choice for those who want to track transactions and manage the personal finance, that is better than simple accounting software. First on our list of 20 best accounting software for Mac is FreshBooks, which is a popular accounting software that makes financial management an easy undertaking. Using the solution, you can handle recurring subscriptions and invoices with relative ease. Oct 28, 2017 Top 10 Best Personal Finance Software for Mac. Moneydance is a powerful yet easy to use personal finance app for Mac, Windows, Linux, iPhone and iPad. With online banking, online bill payment, investment management and budgeting, Moneydance provides all the features of Quicken plus benefits such as ease of use and no sunsetting of features.

A few years ago, we published an article on the best accounting software options for Mac users. This is an update of that article, but here’s the thing: There’s no such thing as “accounting software for Mac” anymore.

Sure, there’s plenty of accounting software that you can use on your MacBook, MacBook Air, MacBook Pro, iMac, etc. But while there used to be Mac software and PC software, it’s now virtually all the same with the ever-increasing expansion of cloud-based software that works seamlessly in any browser.

In other words, you’d have a much harder time finding accounting software that doesn’t work on your Mac than a program that works only on Macs. In fact, with more than 100 million active Mac users, if you found an accounting program that somehow wasn’t compatible with Mac, that alone would be cause for alarm.

Cloud software is here to stay, and the market is only getting bigger. Gartner predicts that by 2022, 28% of enterprise IT spending will have shifted to cloud applications, up from 19% in 2018. (Full report available to Gartner clients.)

6 user-friendly accounting software options for Mac

Rather than giving you a generic list of accounting software that works on Macs (which would basically just be our accounting software directory), I decided to determine which top factors users have for choosing Mac over PC and then find accounting software that best suits those users.

- Macs are typically high-end machines with consistently strong reviews from users, so I included only accounting tools with an overall rating of 4.5/5 stars or higher in our directory (based on verified user ratings) and with at least 100 reviews.

- In general, Macs are considered easier to use than PCs, so I’m including only products with an ease-of-use rating on our site of 4.5/5 or higher.

- Finally, I included only products with a native iOS app with a user rating of 4/5 or better on the App Store, since Mac users typically use iPhones and iPads as well as their desktop or laptop computers.

With those factors in mind, here’s what I found, listed in order of rating and reviews from highest to lowest:

Jump to:

QuickBooks

FreshBooks

Accounting by Wave

Zoho Books

FreeAgent

Kashoo

1. QuickBooks

| User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:14,700+ |

It’s no surprise that the big name in accounting software is available on Mac operating systems. QuickBooks has even had a desktop-only (not cloud-based) option available for Macs since at least the mid-1990s, making the company something of a pioneer for cross-platform functionality.

Now, any of QuickBooks’ cloud-based offerings will work fine on your Apple device, and Intuit even still offers a desktop version for Mac. The desktop version for Mac even has a few features designed specifically for Mac users:

- QuickBooks for Mac 2020 takes advantage of the Mojave OS Dark Mode.

- You can upload text searchable images with the iPhone scanner.

- Documents can be automatically shared through iCloud.

Pros | Cons |

|---|---|

| QuickBooks is available on virtually every device, so whether your team has Macs, PCs, or smartphones, you know that everyone can use it together. | QuickBooks has very attractive entry-level pricing, but it doubles after three months. |

| With hundreds of integrations, QuickBooks is highly customizable. | QuickBooks is an enormous company, and some reviewers find that the customer service isn’t as hands-on as they’d like. |

How much does QuickBooks cost? | |

| QuickBooks Online starts at $25/month. QuickBooks Desktop for Mac is a one-time payment of $299. | |

What about the iOS app? | |

| The QuickBooks iOS app has a 4.7/5 rating on more than 100,000 reviews. It allows users to create invoices, manage expenses, and view reports. | |

The QuickBooks Online dashboard (Source)

2. FreshBooks

| User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:3,000+ |

Designed specifically for small businesses and the self-employed, Toronto-based FreshBooks has been around for more than 15 years. FreshBooks also has Mac users in mind. They say that their easy-to-use accounting software works on any device—desktop, mobile, or tablet—and “plays nicely” with Mac.

Pros | Cons |

|---|---|

| Users rave over FreshBooks’ customer support, and the company stakes their reputation on it. | If your company is rapidly growing—for example, if you plan on going public—you may quickly outgrow FreshBooks. |

| Even though it’s targeted at smaller companies, FreshBooks has all the important accounting features you would need, so it can handle much more than lemonade stands. | Freshbooks does a great job of keeping your books clean, but if you love forecasting and crunching numbers, it’s a little skimpy on the reporting side. |

How much does FreshBooks cost? | |

| FreshBooks starts at $15 per month for five clients and goes up to $50 per month for 500 clients. *At the time of writing, FreshBooks has a fall sale of 60% off for six months on all plans. | |

What about the iOS app? | |

| The FreshBooks app has a 4.8/5 rating on almost 8,000 reviews. It allows you to run invoices, record expenses, track time, and accept payments, all while you’re away from your computer. | |

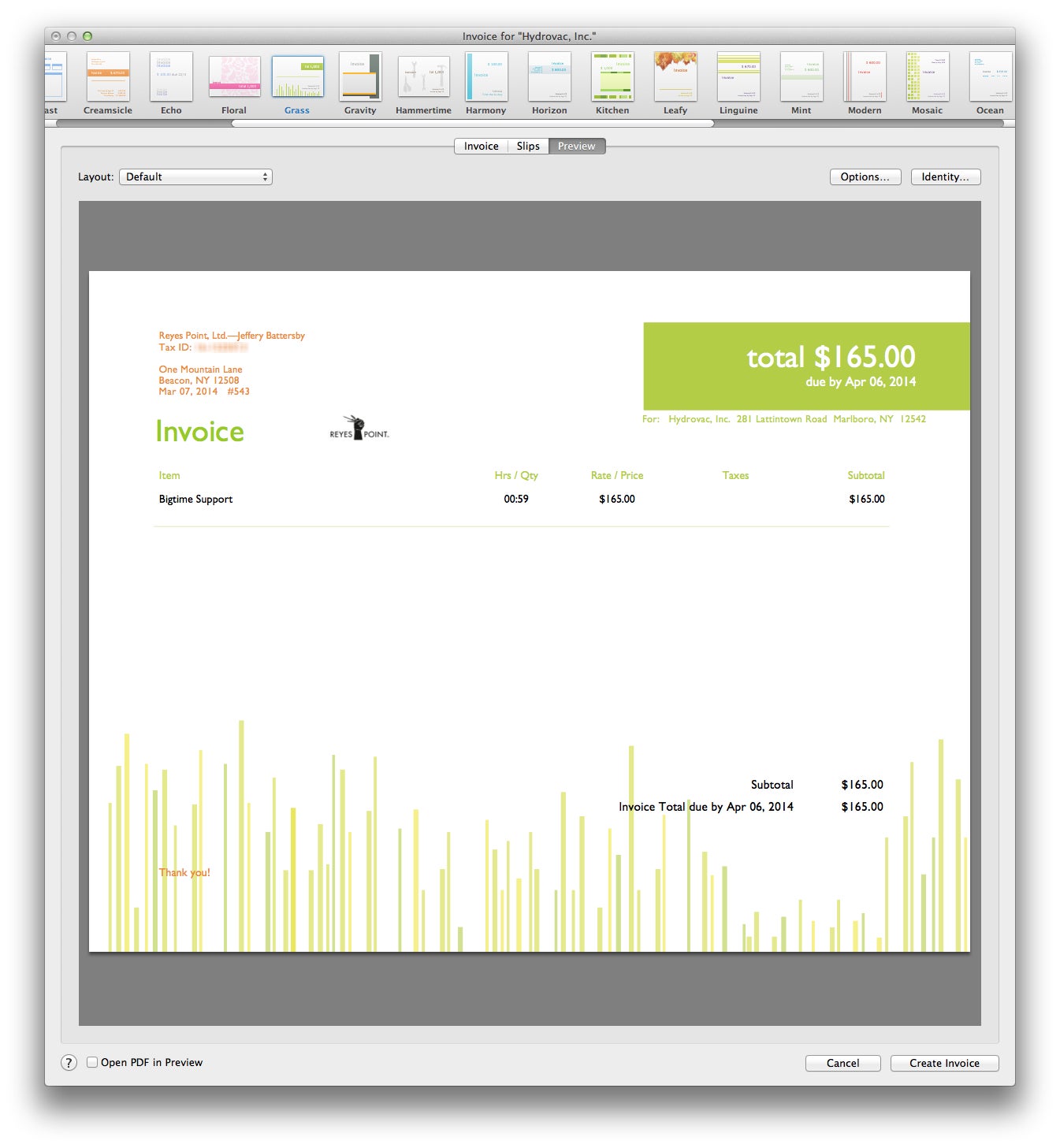

The Invoices dashboard in FreshBooks (Source)

3. Accounting by Wave

| User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:800+ |

Accounting by Wave is one of the youngest tools on this list, having launched out of Toronto in 2010 before being acquired by H&R Block earlier this year. Its biggest differentiator is that it has a completely free version, as long as you don’t need to use it to accept payments or run payroll (those are optional, paid features).

So what makes Wave an attractive option specifically for Mac users? As mentioned, it’s free, so it’ll help you save for the next iPhone or MacBook upgrade. It also scores high for ease of use, making it fit in nicely with the intuitive Mac ecosystem.

Pros | Cons |

|---|---|

| It’s free without limitations on users or transactions as long as you don’t need to accept payments or run payroll. | Wave is missing an audit trail feature, leaving it vulnerable to fraudulent employees. |

| Wave offers above-average reporting features for a free tool. | The free version offers only email support, and even if you pay for payments or payroll you still only get access to chat support (no phone support). |

How much does Wave cost? | |

| Wave is free. Payments are 2.9% + 30 cents per credit transaction, or 1% per bank transaction. Payroll starts at $20 per month plus $4 per employee. | |

What about the iOS app? | |

| Invoice by Wave passes the user review test, clocking in at 4.6/5 with almost 2,000 reviews. It doesn’t completely replace the web version of Wave, but it does allow you to keep an eye on your business finances wherever you are. The biggest complaints that users have seem to be related to customer service, which is not unique to the app. | |

Recent transactions in Accounting by Wave (Source)

4. Zoho Books

| User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:380+ |

If you’re looking for the peace of mind of an established, international company offering Mac-friendly accounting software and you’re trying to avoid QuickBooks for whatever reason, Zoho Books might be for you. Zoho has been releasing business software since 1996, and Zoho Books is specifically tailored for Mac users, as it is designed to work with iMessage, Apple Maps, Siri, and 3D Touch. It even has an app for the Apple Watch.

Pros | Cons |

|---|---|

| Zoho Books is one of the most user-friendly options out there. In fact, it placed fourth—better than any other option on this list—on our Top 20 Most User-Friendly accounting software report earlier this year. | Zoho Books offers integrated payroll in California and Texas for now, but if you’re in any other state you’ll have to use a separate payroll app. |

| Starting at $9 per month, Zoho Books is one of the best values in accounting software this side of Wave, which is free. And unlike Wave, Zoho has almost universally praised customer service. | Zoho Books is optimized for use with Zoho’s customer relationship management system, Zoho CRM, so if you’re already using a different CRM, it won’t work as efficiently. |

How much does Zoho Books cost? | |

| Zoho Books starts at $9 per month or $90 per year for 50 contacts and two users and goes up to $29 per month or $290 per year for unlimited contacts, 10 users, and more features. | |

What about the iOS app? | |

| As mentioned above, the Zoho Books iOS app takes full advantage of iOS-specific features such as messaging and voice assistant, and users love it, giving it a 4.7/5 rating on almost 150 reviews. While some accounting software apps have minimal features, allowing you to basically just check balances and view transactions, Zoho Books allows you to create and send invoices, manage expenses, track time, view reports, and share numbers with your accountant. | |

Managing invoices in Zoho Books (Source)

5. FreeAgent

Open Ipad Apps On Mac

| User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:110+ |

FreeAgent accounting software is based in the U.K. and originally designed for British businesses, but they also have versions customized for U.S. and global businesses, and the software has full multicurrency support. Like any good cloud-based software, FreeAgent works like a breeze on the Mac platform, and its iOS app is a fan favorite.

Pros | Cons |

|---|---|

| Users are quite pleased with FreeAgent’s recurring invoice and receipt scanning features, which help take repetitive tasks out of small business accounting. | FreeAgent is designed for small businesses, so if you’re growing fast, you could outgrow it relatively quickly. |

| Users also have good things to say about FreeAgent’s customer service, which is available by email or phone. | FreeAgent is 50% off for your first six months, but after that it’s $24 per month, which is a little high compared to other options on this list. |

How much does FreeAgent cost? | |

| FreeAgent has a flat-rate of $12 per month for everything (unlimited users and clients) for the first six months, then goes up to $24 per month after that. | |

What about the iOS app? | |

| FreeAgent’s iOS app has an average rating of 4.7/5 on 20 reviews. It allows you to view your accounts, manage expenses by snapping pictures of receipts, create and send invoices, and track time. | |

The main dashboard in FreeAgent accounting for iPad (Source)

6. Kashoo

| User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:110+ |

Once you’ve stopped giggling about the name, you’ll see that Kashoo is a comprehensive accounting tool that is easy to use right from the start on any web-connected device, including Macs. One of Kashoo’s standout features is their customer support: You get free phone and web support with your subscription, which is much easier than standing in line at the Genius Bar.

Pros | Cons |

|---|---|

| The free phone and web support is a real plus for those of us who like to have some expert guidance. | Kashoo integrates with Square for payments and Paychex for payroll in the U.S. (and PaymentEvolution in Canada, where it’s based) but beyond that, it doesn’t have much to offer as far as customization. |

| Kashoo has a flat rate, so you get every feature in the basic plan. | Some users have reported issues syncing multiple bank accounts with Kashoo, so it’s a good thing they have easily accessible customer support. |

How much does Kashoo cost? | |

| Kashoo is $19.95 per month, or $16.58 per month if you pay for an entire year up front ($199). | |

What about the iOS app? | |

| Kashoo’s iOS app has a 4.3/5 rating on more than 50 reviews. It allows Kashoo users to view reports, manage and send invoices, accept payments, and scan receipts. | |

The tax management interface in Kashoo (Source)

What’s your favorite accounting software for Mac?

Are you an accountant (either accidental or professional) and a power Mac user? If so, what’s your weapon of choice, whether it’s listed above or something else? (There are plenty of other options out there with iOS apps, as you can see by filtering for iOS deployment in our accounting software directory.)

I’d love to hear what you use and why you use it so I can recommend it to others. Just let me know in the comments or connect with me on Twitter @AndrewJosConrad.

Note: Listed pros and cons are derived from features listed on the product website and product user reviews on Gartner Digital Markets domains (Capterra, GetApp, and Software Advice). They do not represent the views of, nor constitute an endorsement by, Capterra or its affiliates.

Note:The applications selected in this article are examples to show a feature in context and are not intended as endorsements or recommendations. They have been obtained from sources believed to be reliable at the time of publication.

Looking for Accounting software? Check out Capterra's list of the best Accounting software solutions.

Aug 13,2019 • Filed to: PDF Tips

Keeping track of your finances and expenses is one way to ensure you remain on top of your money situation. Doing that without the right program can be difficult, which is why there are so many personal accounting programs to choose programs. Yet, choosing the right one can be just as difficult. In this article, we are going to be looking at some of the best personal accounting software for you to choose from. Some are free, others charge a small fee but each one has features that are designed to make it easy for you to keep track of your money.

Top 5 Best Personal Accounting Software for Mac and Windows

#1. PDFelement Pro

Accounting requires documentation and therefore you need the best PDF software to make it easier to not just organize the documents but also edit and maintain them. The best personal accounting software for mac and Window to help you with this kind of documentation is PDFelement Pro. With the help of this personal accounting software, your works with accounting will be easier and faster.

Pros:

- It allows you to edit both text and images on the PDF document.

- You can also use it to add a password and a watermark to protect documents that you don't want to share with the wrong individuals.

- But perhaps the most useful feature for accounting purposes is iSkysoft's form filing feature. With it, you can fill in both interactive and non-interactive form fields very easily. This feature would come in handy when filling in tax forms.

- You can also use it to easily organize the PDF files you have by bookmarking them or using the bates numbering system to make indexing easier.

Cons:

- No cons observed so far.

We hope that one or more of the above personal accounting software can help you meet your expense tracking and budgeting needs. Documentation that is a major part of accounting can be created, edited and organized using PDFelement Pro.

#2. iBank

iBank 5 is a program that is designed to help you keep your earnings and expenses in check. It has features that can download transactions from your bank and credit card accounts although you can just easily import these transactions into the program. It also budgeting options to allow you track how you spend your money.

Pros:

- Integrates with your bank accounts and credit card accounts.

- Supports multiple currencies.

- Syncs data with iPhone and iPad apps.

Cons:

- It is only available for Mac users.

- At $59.99 it is a little bit out of reach for most users although it does have a 30-day free trial.

#3. Moneydance

Moneydance is another personal finance program that comes packed with all the features a user would need to manage their finances. It easily downloads banking information in just a click and can handle transactions in multiple currencies. Available for Windows, Mac and Linus, Moneydance also comes with iOS apps that provide detailed transactions

Pros:

- Adding banking information is very easy.

- It is available for Mac, Windows and Linux.

- Supports multiple currencies.

Cons:

- It is a difficult program to use especially for beginners even though there are detailed tutorials on how to use the program.

- It is bit on the expensive side at $50.

#4. Quicken Personal Finance Software

Quicken is a recognizable program that has been around for quite a while. During that time, the program has added more features designed to help the individual keep track of their finances. Although it originally started out as a Windows compatible program, it has grown to be available for both Windows and Mac and even comes with iOS and Android apps that sync with the desktop version. Reporting is excellent and the dashboard is easy to navigate. The free version however is limited in features although the Starter Edition, Quicken Home and Quicken Business can offer more options.

Pros:

- It has a clean user-interface that makes it very easy to use the program.

- Reporting is easy and so is importing data from bank accounts and credit card accounts.

- It has Android and iOS apps.

Best Accounting Apps For Ipad

Cons:

- The free version lacks some reporting features that can make proper assessment difficult.

#5. You Need a Budget

Also known as YNAB, You need a budget is a personal financial management tool that is designed to make it easy for beginners to track their expenses and make a budget. It is more of a tool to teach proper financial practices than a personal accounting app but also has a lot of tools that make tracking money easier. It will help users avoid overdrawn accounts and help a person remain on budget. It also comes with companion iOS and Android apps that sync with the information you have on the desktop version.

Pros:

- It provides tools to help you not just keep track of expenses but also create a budget and stick to it.

- You can sync data with your YNAB iOS or Android apps.

- It has a clean user interface that is very simple to use and ideal for the beginner user.

- You get 34 days free trial and only pay $5 after.

Cons:

- Advanced features like tax estimates are missing.

#6. AceMoney

AceMoney is another simple yet highly effective free personal accounting software that comes packed with features to help you keep your expenses on track. It has been translated into very many different languages and has features that are ideal for tracking expenses and budgets, allowing you to maintain a proper record of how you make and spend money. It supports more than 150 currencies and financial data can be imported from accounts, other financial software or spreadsheets. It is available for both Mac and Windows and it will cost you about $40 to purchase.

Pros:

- It is available for both Mac and Windows OS.

- It has excellent tracking capabilities, allowing users to track both expenses and budgets.

- You can easily import information from other sources.

Cons:

- It lacks mobile apps.

- The user-interface is not as organized or attractive